Solo 401k profit sharing calculation

Form 1120S line 23 Employer contribution. Having Staff with a Solo 401k Plan.

Solo 401k Contribution Calculator Solo 401k

The rules can vary by plan and plan participants should always consult their plan documentation to see the specific rules that will apply.

. Solo 401k SEP IRA. Borrow up to 50000 from Solo 401k or Individual 401k for any purpose. 1 Put 20500 of my private practice income into my solo 401k and match 25.

The general 401k plan gives employees an incentive to save for retirement by allowing them to designate funds as 401k. Side practice 50k of 1099 income solo 401k 27293 contribution. The distinction between a tax-free Roth Solo 401k and a tax-deferred Solo 401k.

In addition calculating profit-sharing contributions for sole proprietorships and partnerships tends to be complex because it requires modified net profits. A self-employed 401k plan is also know as a Solo 401k plan. For 2021 the IRS says you can contribute up to 61000 in your self-employed 401k plan.

Employer match or profit-sharing contributions arent included in these limits. The Owners-Only 401k Plan. So would this calculation be correct if I also want to contribute 25 towards profit sharing.

On C-Corp 1120 returns it is line 23. The business can also fund your SEP IRA solo 401k plan profit sharing plan defined benefits plan cash balance plan and other retirement plan mechanisms. That makes 25625 2 Take my 12 employer match into 403b which will be 25k 3 Use my 403b employee contribution to get to the 61k limit.

The specific calculation will discount this 31 million amount based on the employee age and using an assumed interest rate over a 10-year period. A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. Rental price 70 per night.

Lifetime Income Illustration Tool. Its a traditional 401k plan covering a business owner with no employees or that person and his or her spouse. Typically single-member LLC profit sharing contributions are 20 of net compensation.

Contribution limits in a one-participant 401k. If you receive 70000 in W-2 wages for instance your profit-sharing contribution could be up to 17500 70000 x 25. IRC 410b coverage test.

To pass the coverage test each contribution made to the plan during the year eg elective salary deferrals matching and profit sharing must satisfy either the ratio percentage or the average benefit test. W-2 box 12 Employee contribution For S-Corps on the 1120-S Form the line on which pension profit-sharing plan contributions get reported is LINE 17. Etc but you get the idea.

To demonstrate the plan covered ie benefitted enough non-HCEs during the year. Remember that even with a solo 401k you should have your rules written down and documented. Due to the nature of the plan the calculation works out to the lifetime limit of 31 million at age 62.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. However keep in mind all. In 2022 100 of W-2 wages up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k.

Periodical employee contributions come directly out of their paychecks and may be matched by the employerThis legal option is what makes 401k plans attractive to employees and many. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. The only other difference is that there is a possible fee involved because of the 401k plan section of a Solo 401k whereas theres no such fee for the SEP IRA.

This article will discuss how much you can contribute to your self-employed 401k plan. The 457 plan limit is separate from the 401k403bTSP limit. We have switched to a profit sharing 401k for 2015.

401k Rollover to IRA. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. What is the most I can contribute to a cash balance plan.

In the United States a 401k plan is an employer-sponsored defined-contribution personal pension savings account as defined in subsection 401k of the US. The ratio percentage test is the. Added benefit of my solo 401k is that it accepts rollover deductable contributions which enabled me to back door roth the non-deductable left over in my IRA.

As a result corporations place limits on the annual amount of employee savings both the employee and profit sharing employer amounts. A Solo 401k also known as a Self Employed 401k or Individual 401k is a 401k qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the business owners and their spouses. Yes its a Solo 401k plan but yes your spouse can join in the plan as well.

Loan Amount Calculation QUESTION. These plans have the same rules and requirements as any other 401k plan. 401k Rollover to IRA.

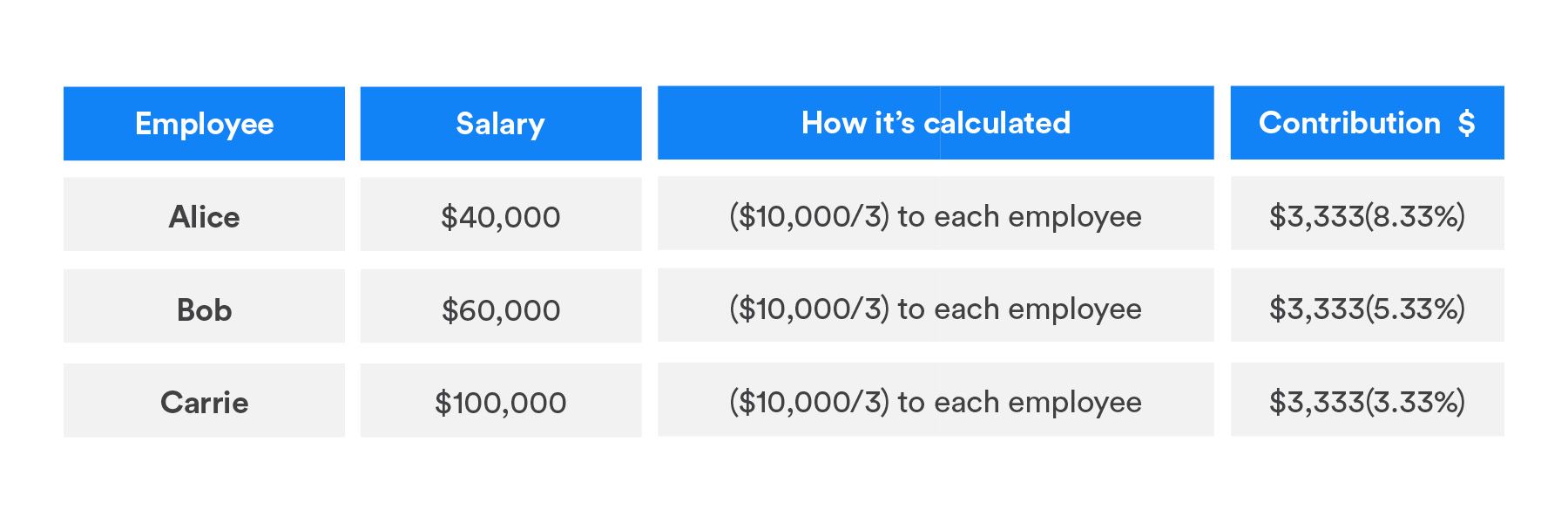

Contribution and Eligibility Calculator. In addition we used a 40 salary calculation simply for the. Salary 26000 wife elective.

Code L is to be used on Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc to report the distribution. The Nabers Group Solo. Lifetime Income Illustration Tool.

Skip to content. Solo 401k Solo-k Uni-k. Solo 401k contribution calculation for a sole proprietorship partnership or an LLC taxed as a sole proprietorship.

Contribution and Eligibility Calculator. However there are a couple of basic rules that will always hold true when it comes to a hardship 401k withdrawal. A solo 401k may not be right for small businesses that plan to expand and hire employees in the near-term since doing so would likely result in plan ineligibility.

The Solo 401k Profit Sharing Contribution is also known as the Employer Contribution. Solo 401k SEP IRA. Unlike the employee deferral contribution which is a dollar-for-dollar contribution the Solo 401k plan employer contribution is based on a.

Back door Roth -55k. If you work for multiple employers in the same year or if your employer offers multiple plans you have one single employee contribution limit for 401k 403b and TSP across all plans. However if that employee limit is across all employers than I cant do step 3.

When added to a salary-deferral contribution of 19000 the total would. Summary of where to report the two Solo 401k contributions for S-corporations. For 2022 you can make a contribution of 40500 which is an increase of 2000 from 2021 no matter your age.

This is a complex strategy that requires meticulous calculation and excellent documentation. The Solo 401k is Better than the SEP IRA because of the 401k feature and that the profit sharing feature is Already Part of the Solo 401k. We prepare Solo 401k Plan loan documents in 24 hours.

The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The one-participant 401k plan isnt a new type of 401k plan.

How Much Can I Contribute To My Self Employed 401k Plan

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Planner Early Retirement

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

Column Two Rival Experts Agree 401 K Plans Haven T Helped You Save Enough For Retirement How To Plan Changing Jobs Retirement Accounts

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution For Partnership And Compensation

Solo 401k Contribution And Deduction

401 K Profit Sharing Plans How They Work For Everyone

Solo 401k Contribution Limits And Types

How Do I Calculate How Much Money Is Available For A 401 K Loan

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

D Dyosviq74 Um

Solo 401k Contribution Limits And Types

Are Discretionary Matching Contributions Becoming A Little Less Discretionary