Calculate employee retention credit

The first was under the Consolidated Appropriations Act 2021 and later was under the American Rescue Plan Act. Find current guidance on the Employee Retention Credit for qualified wages paid during these dates.

2

Similarly for 2021 the retention credit is capped at 70 of qualified employers from January 1 2021 to.

. Dont leave money on the table. Calculating the employee retention credit is simple yet complicated. The employee retention credit is a payroll tax credit that applies towards Social Security taxes and is fully refundable.

Ad Our Tax Professionals Can Help Determine If You Qualify for the ERTC from the IRS. You can earn a tax credit of up to 33000 per employee in wages paid under the Employee Retention Credit ERC if your business was financially impacted by COVID-19. Talk to our skilled attorneys about the Employee Retention Credit.

We Only Specialize In Maximizing Employee Retention Tax Credits For Small Business Owners. The Employee Retention Credit Cant Be Overlooked. The benefits of calculating your employee retention credit include.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. See if your business qualifies for. Businesses are eligible to claim credit for.

A refund for employee wages paid in 2020 claim your refund credit of up to 5000 per employee only. Get up to 26k per employee. For 2020 if taxes have already been filed file Form 941-X to amend the.

We Document Eligibility Calculate ERC Submit. Read on to learn. However the overall ERC program is pretty complicated.

Our Average ERC Client Receives over 1M. Any employers with a maximum of 10000 wages were eligible. Ad IRS is giving businesses 26K per employee With No Repayment.

Check to see if you qualify. You Took Care of Your People Our Industry Expertise Will Help You To Claim Your ERC. All you need is to understand its ways of calculation minutely.

If you filed Form 941-X to claim the Employee Retention Credit you must reduce your deduction for wages by the amount of the credit and you may need to amend your income tax. Ready to Get Started. Take our short quiz to get an idea of how the ERC can benefit your business.

Get help retroactively claiming the Employee Retention Tax Credit for your business. Ad We take the confusion out of ERC funding and specialize in working with small businesses. For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter.

The credit remains at 70 of. The employee retention credit can provide much-needed relief to plenty of business owners who were impacted during. American Rescue Plan Act 2021.

This Page is Not Current. How Do I Calculate Full-Time Employee Retention Credit. The employee retention credit is a credit created to encourage employers to keep their employees on the payroll.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. ERC ERTC Employee Tax Credit. Further details on how to calculate and claim the employee retention credit for the first two calendar quarters of 2021 can be found in Notice 2021-23.

Use our simple calculator to see if you qualify for the ERC and if so by how much. For purposes of the Employee Retention Credit to determine whether an employer has a significant decline in gross receipts an employer that acquires in an asset purchase. Ad Unsure if You Qualify for ERC.

Get your tax credit quickly. Qualified employers can claim up to 50 of their employees. How to calculate the Employee Retention Credit.

After March 12 2020 and before January 1 2021. Talk to our skilled attorneys about the Employee Retention Credit. The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act.

In 2020 the Employee Retention Credit is half of the qualified employee wages received in a fiscal quarter. Up to 26000 per employee. Ad Unsure if You Qualify for ERC.

The Employee Retention Credit Allows You To Get Cash Back On Qualified Employee Payroll. Ad We specialize in maximizing ERC Funding. Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult.

EY Employee Retention Credit Calculator. No limit on funding. For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter.

The ERC Calculator will ask questions about the companys gross receipts and employee counts in. Calculate Your ERC Refund. The credit applies to wages paid after March 12 2020 and.

Ad If You Had W2 Employees Between 2020-21 You May Qualify For Tax Credits.

Get Hold Of The Worker Retention Tax Credit Score Ertc Underneath The Second Spherical Of Covid Aid Up To Date Zet Business

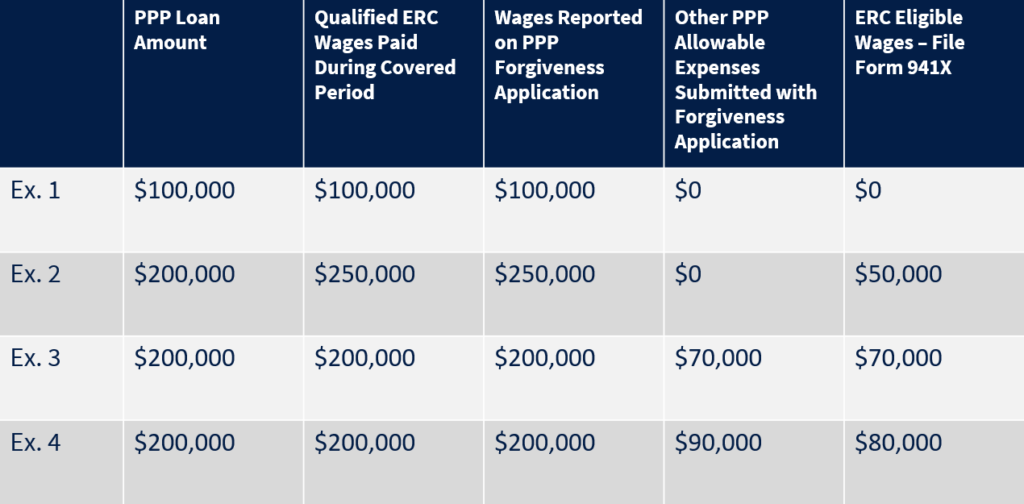

Employee Retention Credit Irs Updates Guidance On Ppp Coordination Issues And More Sc H Group

Employee Retention Credit Erc Calculator Gusto

Covid 19 Relief Legislation Expands Employee Retention Credit Insights Ksm Katz Sapper Miller

How To Claim The Employee Retention Credit In 2022 Hourly Inc

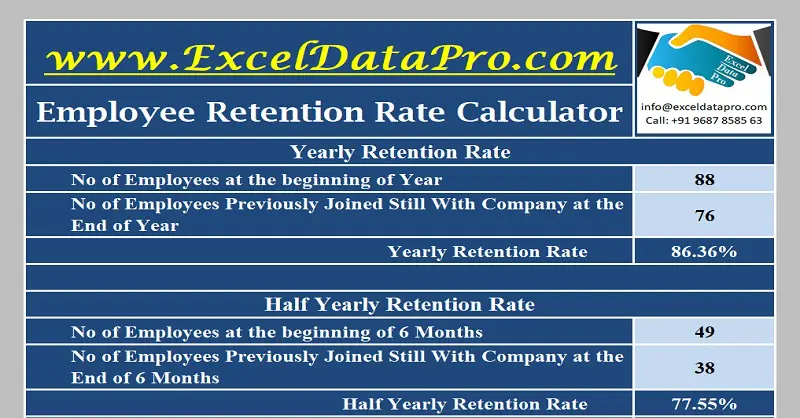

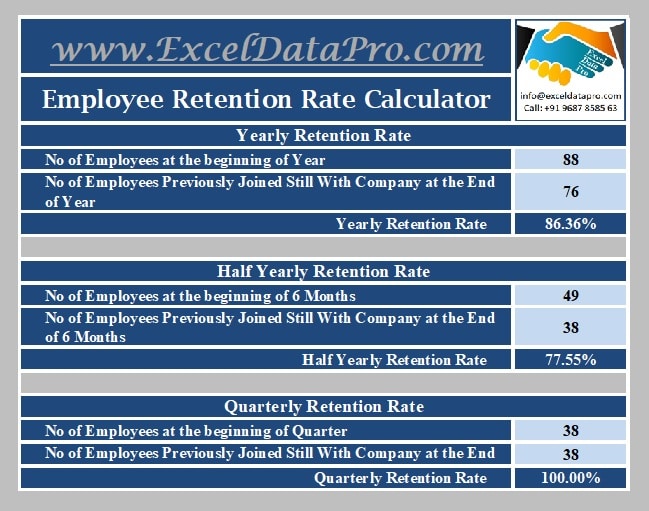

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Employee Retention Credit Erc Calculator Gusto

Employee Retention Tax Credit Significantly Modified And Expanded For Businesses Shindelrock

Employee Retention Credit Spreadsheet Youtube

2

2

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Employee Retention Credit Erc Consulting P3 Cost Analysts